IFS #1 in market share and year-over-year growth

IFS offers powerful and flexible Enterprise Asset Management software solutions and Asset Investment Planning, to handle the complex asset demands of asset-intensive organizations: IFS Cloud EAM, IFS Ultimo, and the latest acquisition, Copperleaf Technologies. Our breadth of capabilities supports both current and future needs.

IFS Cloud EAM

Manage assets from the cradle to the grave. With asset lifecycle management AI capabilities and enhanced asset performance you can understand the complete view of your asset position.

Copperleaf

Maximize your asset portfolio value with tools for strategic planning, resource optimization, and scenario analysis for informed decision-making and efficient capital allocation.

IFS Ultimo

Focuses on maintenance and safety and specializes in managing industrial assets, fleet assets and healthcare technology management. The solution fully integrates broad EHS & Operations suite.

IFS named a 2024 Gartner® Peer Insights™ Customers' Choice for EAM

IFS the only company named as a Customers’ Choice in the 2025 Gartner® Peer Insights™ Voice of the Customer for Enterprise Asset Management Software report

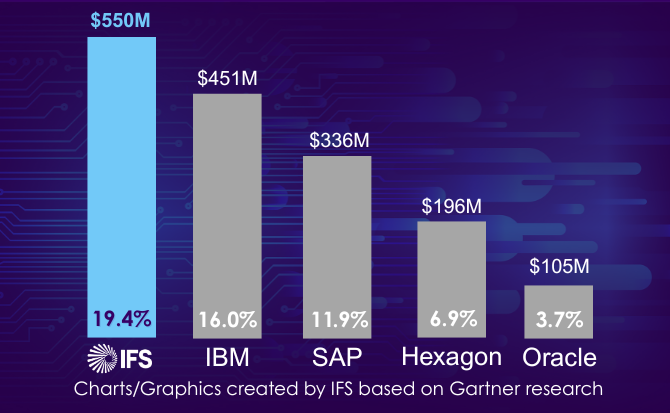

IFS ranked #1 for EAM Market Share

IFS is ranked #1 for EAM Market Share in the Gartner Market Share: Enterprise Software, Worldwide, 2024 in enterprise asset management (EAM) segment by market share.

Capabilities

-

Asset Lifecycle Management

IFS offers EAM software AI-powered asset lifecycle management software used by asset-centric organizations around the world. The solution helps them optimize asset operations, maintenance, and performance to drive cost and gas emissions reduction and realize operational efficiencies.

Asset Lifecycle Management in IFS Cloud is designed to meet your complex needs to enable you to manage and maintain your assets confidently from operational design to decommissioning. Leverage insights and make better decisions to save time and reduce errors, ensuring your assets are aligned with your strategic and ESG goals.

IFS offers enterprise asset management solutions that support many of the world’s largest asset owners. These include oil and gas rigs, mines, aircraft, ships, transmission lines, wind farms, manufacturing machinery and equipment and many more.

-

Asset Performance Management

IFS helps organizations around the world track and monitor the status, condition, and health of their assets. IFS Asset performance management software enables you to gain insights from your assets to reduce asset downtime and drive asset availability. Enable optimal and efficient energy use and performance of your assets to drive more sustainable and greener operations.

Increase the operational efficiency of your assets and ensure your asset maintenance plans are aligned with the status of your assets. Organizations that own and manage their assets across Energy, Utilities and Resources, Manufacturing, Aerospace & Defense use IFS’s Asset Performance Management solution to drive asset reliability and availability and reduce asset failures and downtime.

-

Aviation Maintenance

IFS offers Aviation Maintenance solutions that enable aerospace and defense organizations to return aircrafts or other assets back to the air on schedule. Planners, line/forward maintenance, and maintenance operators can drive fleet-airworthy availability, support day operations, and enable consistent and fast aircraft turnaround times efficiently.

IFS Maintenix and IFS Cloud provide the critical capabilities to manage, control and enhance the full spectrum of your operational maintenance program from planning, scheduling and coordination to execution, efficiently and securely. IFS works with aerospace and defense organizations from all over the world to manage, maintain and operate their large and complex operations efficiently.

-

Asset and Fleet Management

IFS collaborates with major fleet and asset owners worldwide, offering solutions to meet their fleet and asset management requirements. IFS Cloud software empowers fleet managers to achieve optimal availability goals and to reduce the challenges of financial and regulatory management. With IFS Cloud, you can determine configurations and maintenance policies, but also facilitate maintenance and logistics planning and execution.

Leverage IFS fleet asset management capabilities to manage and operate your fleet remotely and increase its lifespan while optimizing your resources. The solution is designed so you can increase health and safety practices and standards but also reduce maintenance and inspection costs with a minimum impact on your operations.

-

Fleet Maintenance & Logistics

IFS Ultimo software enables you to set up your fleet maintenance efficiently with minimal downtime. The software gives you complete insight into all the elements of your fleet: maintenance, history, contracts, insurances, mileage, dynamic vehicle data, and scheduling preventive maintenance. Record sustained damages and defects and determine the ideal time to fix them. Aim for maximum availability. The ultimate goal: control the Total Cost of Ownership of your fleet.

The Fleet Management & Logistics solution is also deployable for maintenance management around warehouses, cranes, pipelines, and other logistics assets. Distribution centers, ports, and oil terminals also improve the uptime of moving and fixed assets, reduce maintenance costs, and operate more safely with the deployment of the software.

-

Health, Safety, and Environment Management

The IFS Ultimo EHS software (HSE software) aligns maintenance processes with industry and government regulations within a single EAM system. Benefit from a fully digital work permit administration, including digital validation on issuing, renewal, and completion. Integrate the Lockout Tagout procedure into your maintenance and work permit process. Monitor EHS incidents and take appropriate action. Process modifications in a structured manner so you can integrate them with your current work order flow/process and project management.

IFS Ultimo offers a fully integrated and comprehensive EHS software suite, including EHS Incident Management, Management of Change, Work Permits, Task Risk Assessment, and Lockout Tagout. This simplifies compliance with different inspections and regulations. Hundreds of organizations in multiple industries benefit from having EHS processes integrated into their EAM system. This results in economies of scale and much smoother communication between departments, which has a positive impact on the number of incidents.

-

Healthcare Technology Management

IFS Ultimo supports Healthcare organizations by maximizing asset availability, compliance, and improving productivity. The Healthcare Technology Management (HTM) software in the EAM/CMMS platform is fully integrated with Healthcare Facility Management capabilities, which enables complete and efficient asset management and better collaboration between the biomedical, maintenance/facility, and IT departments within hospitals.

Hundreds of hospitals worldwide benefit from clear recording of medical equipment with the software. Efficient planning with graphical planners for preventive maintenance, release conditions and extensive cost tracking make it easier for these organizations to comply with important legislation, standards and guidelines.

-

Maintenance Management (CMMS)

We offer you the support of a regular CMMS system, but with IFS Ultimo EAM you invest in a more complete and future-proof solution. With a CMMS, you increase the efficiency of the maintenance department by automating maintenance management activities and intelligently scheduling your operations. The solution fully integrates a broad HSE & Operations suite.

Thousands of organizations worldwide experience the benefits of working with IFS Ultimo's plug-and-play EAM system every day. The software is widely used within manufacturing, logistics and healthcare. Ultimo's EAM platform gives you the certainty of a flexible Asset Management system. All in line with the size, maturity, and budget of your organization.

-

Maintenance, Repair, Overhaul (MRO)

IFS Maintenance, Repair and Overhaul (MRO) solutions enable competitive business, best practice and compliant delivery of airworthy assets. Reduce overall turnaround times without sacrificing compliance, regulatory requirements, or safety standards. Maximize efficiency, meet requirements, and increase profitability with an enhanced MRO solution that meets your needs.

IFS has unparalleled knowledge and is a leading global supplier within the MRO space delivering value to MRO providers like yours with a solution that helps your organization remain competitive and profitable. Enhance your maintenance processes and meet turnaround time commitments. Improve decision-making, optimize resources to minimize maintenance delays and drive maintenance efficiency and predictability.

Enterprise Asset Management (EAM) software solutions for your industry

Get in touch

Frequently asked questions

-

What is Enterprise Asset Management?

Enterprise Asset Management (EAM) involves the comprehensive tracking, maintenance, and optimization of assets across an organization. It supports better decision-making and operational efficiency.

-

What is Asset Lifecycle Management?

Asset Lifecycle Management (ALM) is the strategic approach to managing physical assets from acquisition to disposal. It helps organizations optimize performance, reduce costs, and align with sustainability goals.

-

What is Asset Performance Management?

Asset Performance Management (APM) combines data, analytics, and maintenance strategies to optimize asset reliability, availability, and ROI. It helps organizations make smarter decisions about asset health and performance.

-

What is Asset Investment Planning?

Asset Investment Planning (AIP) helps organizations prioritize and plan asset-related investments based on risk, performance, and strategic value. It’s key to long-term asset sustainability.